Investor Profile

Diversified Portfolio Strategy

Residential Mortgage Origination

Real Estate Development (REIT)

Alternative Asset Allocation

Securities Offered

EquityLine Diversity Limited Partnership, under the management of its general partner EquityLine Diversity Inc., intends to offer limited partnership units at an initial price of $10 per Unit until December 31, 2023. Subsequently, the pricing will align with the net asset value per unit.

The Units are available through private placement, adhering to exemptions from prospectus and registration requirements as stipulated by relevant securities laws. The offering is extended to eligible subscribers meeting the criteria of “accredited investors” as defined in NI 45-106 under applicable Canadian securities laws. Non-residents have the option to invest through a Canadian resident corporation, provided compliance with applicable securities laws.

Investing with confidence

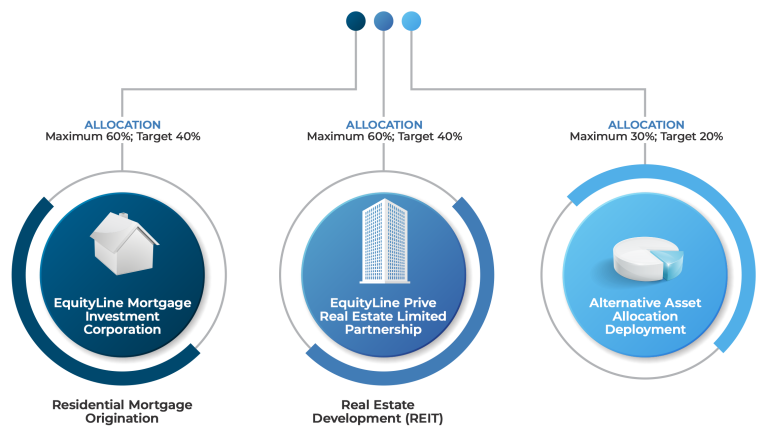

Primary Asset Allocation Model

The partnership will allocate capital through various strategies to a diverse set of companies and projects to construct a portfolio of private and public income and capital gain generating investments. Portfolio investments will generally be structured as one or a combination of the following:

Our Strategy

Balanced Revenue Model

A model was developed to strike a balance between the partnership’s objectives of ensuring steady income and a financial safety net, while also seeking enhanced returns by incorporating real estate ownership and development into a portion of the portfolio.

Our primary aim is to strategically align the partnership’s financial stability and liquidity, effectively leveraging them in tandem to capitalize on the inherent potential for lucrative benefits within a thoughtfully executed real estate ownership approach.

Investor Distributions

The Partnership aims to issue quarterly distributions to holders of each Class based on the available cash for distribution within the Partnership. The distribution amounts may vary, and there is no guarantee of distributions in any specific period or of a predetermined amount.

Distributions will be made on an equal per Unit basis as follows

100% will be distributed to the Unitholders quarterly until such Unitholders have received a return on the NAV calculated on a per Unit basis equal to 8% on an annualized basis.

75% to the Unitholders and 25% to the General Partner until the Unitholders have received a return in excess of the annualized 8% on NAV paid under (a) until the Unitholders have been paid a return equal to an annualized 10% return on NAV calculated on a per Unit basis.

The remainder over an annualized 10% return paid on NAV calculated on a per Unit basis will be paid 50% to the GP and 50% to the Unitholders.

Minimum/Maximum Offering

The minimum investment for an investor will be $10,000. These minimum amounts may be waived by the General Partner in its sole discretion.

Investment Terms Highlights

Lorem ipsum

Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Contact Us

550 Highway 7 East Suite 338 Richmond Hill, Ontario L4B 3Z4